According to their most recent amendment, Triller wants a direct listing on the NYSE “on or about 2024“. Without providing a specific month or quarter for its IPO. But that’s not the most interesting thing in the document. Triller revealed within the new amendment’s ‘Risk Factors’ section some jaw-dropping facts. It tells a story of a company facing financial chanciness and a number of legal problems.

We’ve put together four of Triller’s most surprising declarations – including it confirms raising over $420 million to date from investors:

1. Triller’s Legal Issues are Stockpiled

Triller was sued by Universal Music Publishing Group over unpaid licensing fees in January 2023, and reports in its S-1 document that UMPG filed a motion for summary judgment on August 31, 2023, “seeking damages in the amount of $2.9 million, reflecting the sum of unpaid amounts under the agreements and interest at a rate of 10 percent per annum commencing on January 5, 2023″.

Triller reports the hearing on the motion for summary judgment was set for November 21, 2023, and “the Company has accrued $1.5 million in liability to the plaintiff [UMPG] but cannot reasonably estimate the amount or range of any additional losses it may incur in connection with this matter”.

Universal’s legal action followed a lawsuit filed by Sony Music Entertainment in August 2022, when it sued Triller for allegedly failing to pay licensing fees of “millions of dollars.” Triller settled Sony’s lawsuit in April 2023 by agreeing to pay $4.6 million for the alleged contract breaches. It also reported entering a ‘Confidential Settlement Agreement’ dated July 21, 2023, to resolve “Plaintiffs’ [SME’s] remaining claims and provide for an agreed plan for payment of the judgment, pursuant to which we agreed to pay an additional sum of money to Plaintiffs”.

Triller claims that “within fifteen days of a direct listing [on the NYSE], we will be obligated to pay the Plaintiffs [SME] pursuant to the Confidential Settlement Agreement.”

Timbaland and Swizz Beatz were behind one of Triller’s highly publicised lawsuits. The lawsuit was filed in August 2022 with a demand of $28 million in missing payments pertaining to buying out Verzuz in early 2021.

According to Triller, “in connection with our settlement of disputes related to our acquisition of Verzuz”, in September 2022 they “agreed to assign the intellectual property of Verzuz LLC and execute documents of transfer of such intellectual property in the event we did not make certain payments in the aggregate amount of approximately $9.0 million by January 31, 2023″.

Triller says that it “did not make such payments in full” by the due date. As a result, in August last year, the company received a letter from the founders of Verzuz LLC “asserting ownership over Verzuz copyrights and trademarks”.

Triller adds that it currently has “no intention” of transferring ownership of Verzuz back to the brand’s founders, but concedes that it “may be compelled to transfer such intellectual property in the future, which could hurt our business prospects”.

Triller says that it owes “approximately $37.0 million, plus interest, to the owners of Verzuz, which is due and payable”, while noting that “as of September 30, 2023, this amount significantly exceeds our cash balance of $1.0 million.”

2. Verzuz “Is Not A Material Contributor” To Triller’s Revenue

Triller reports in its prospectus that, if it were to lose the intellectual property related to the Verzuz beat battle series, it would not “negatively impact [its]business and results of operations”.

It believes this to be the case due to what it calls “integration challenges that occurred since the Verzuz acquisition closed”.

Triller explains: “When we acquired Verzuz in 2021, we believed we were capable of converting the large following Verzuz had accumulated on social media into paying users and long-term value contributors to our ecosystem.”

“Our attempts to monetise Verzuz events and convert users from ‘free’ to ‘paying’ users proved to be more challenging than anticipated.”

As a result, Triller says it has not produced a Verzuz event since July 2022.

The company adds: “Verzuz therefore is not a material contributor to our revenue and only an insignificant number of Verzuz users have been included in our user base, business model or assumptions.”

“While Verzuz is not generating revenue or converting to paid users as we hoped, we still believe the brand name itself has value and in the future if we are unable to realize the full carried value, which we still believe to be achievable, we would then need to reassess.”

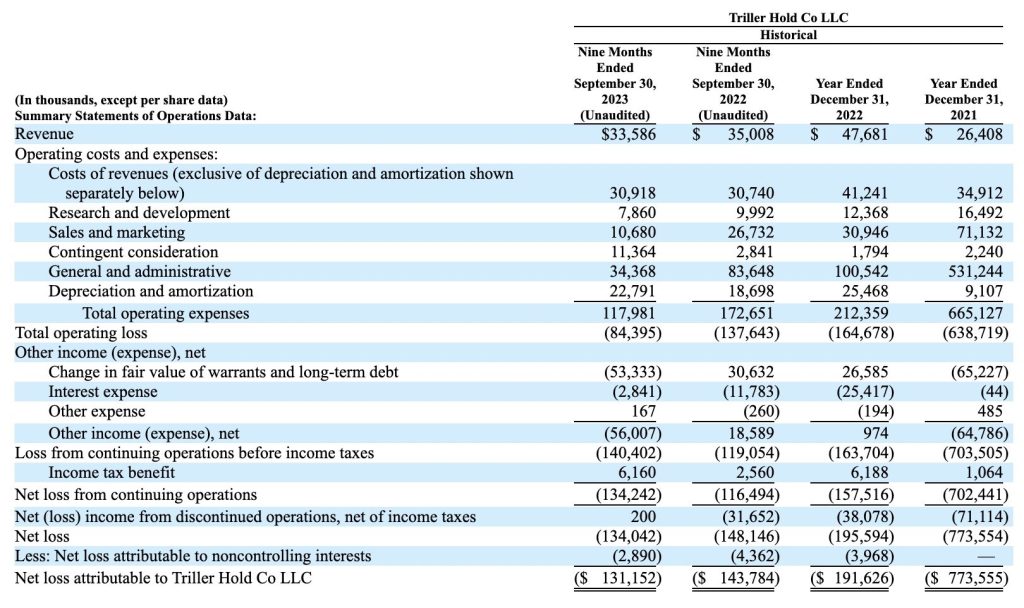

Triller reports that it generated revenues of $33.586 million in the nine months to the end of September 2023.

The company incurred a net loss of $131.2 million in the nine months ended September 30, 2023 and $143.5 million for the fiscal year ended December 31, 2022 (see below).

3. TRILLER OWES MUSIC RIGHTSHOLDERS OVER $23 MILLION

According to Triller, its outstanding music licensing-related payment obligations were $23.6 million as of September 30, 2023. They also admit that the outstanding payments exceeds current cash balance, and “could impact our ability to obtain financing in the future”.

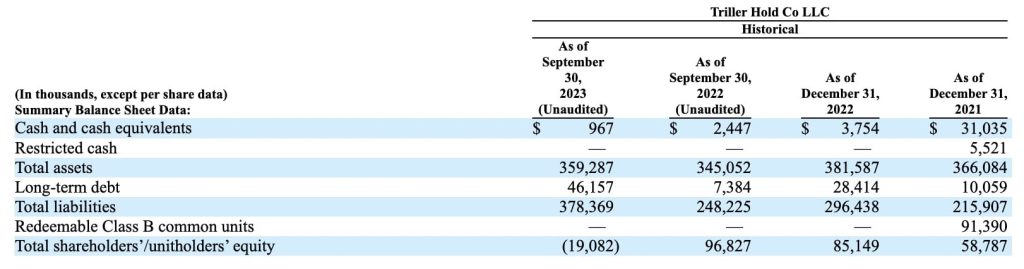

As of September 30, according to the SEC filing, Triller Hold Co LLC had “cash and cash equivalents” of $967,000 (see below).

According to Triller: “We are not in compliance with the payment obligations of a significant number of our contracts with certain of our counterparties, including with respect to our music licenses, as a result of our inability to make certain fee payments required pursuant to such agreements or our failure to make such payments on time.”

In addition to “being behind on payments to music licensing counterparties”, Triller says it is “overdue on payments to other parties and vendors, including but not limited to those providing us with engineering, marketing and legal services”.

Triller adds in this section that “while we are currently working with our partners and counterparties and/or negotiating the terms of these various agreements, if we are unsuccessful in renegotiating these agreements or receiving waivers of the due date of payments required… our partners and vendors could terminate these agreements and require us to make these fee payments in their entirety.”

The company adds: “Further, if our music licensing partners terminate our agreements, we will also lose the right to include their content on our platform. Such counterparties have in the past and may in the future look to file litigation against us seeking such overdue payment, which could have an adverse effect on our business, financial condition, and results of operations.”

4. Triller Has Raised Close To Half A Billion Dollars In Capital To Date, And It Just Purged 200M Accounts…

Triller reports raising more than $420 million in capital since its inception and that it “established more than 500 million Consumer Accounts” on the Triller app and a total of “633 million Consumer Accounts on our Technology Platform”.

However, the company says that it “recently undertook a robust process to purge as many of the duplicate and bot accounts as practicable with our resources and in doing so we purged in excess of 200 million Consumer Accounts from our total user accounts metric”.

The Amendment shows its current net Consumer Accounts number stands at 327 million on the Triller app, with a total of 433 million Consumer Accounts on its Technology Platform.

Triller says that it “elected to take a proactive approach to the way in which we report our Consumer Accounts, which we believe is uncommon in our industry”.

The company also claims that “many social media companies include a significant number of “bot” accounts or “duplicate” accounts in their user metrics”.

“While we believe that many social media companies include a significant number of “Bot” accounts or “Duplicate” accounts in their user metrics, we recently undertook a robust process to purge as many of the duplicate and bot accounts as practicable with our resources.”

Triller